Does Amira Nature Foods Ltd’s (NYSE:ANFI) CEO Pay Matter?

By: Alice T. with Newsbuzz Team

Karan Chanana became the CEO of Amira Nature Foods Ltd (NYSE:ANFI) in 2012. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. And finally – as a second measure of performance – we will look at the returns shareholders have received over the last few years. This method should give us information to assess how appropriately the company pays the CEO.

How Does Karan Chanana’s Compensation Compare With Similar Sized Companies?

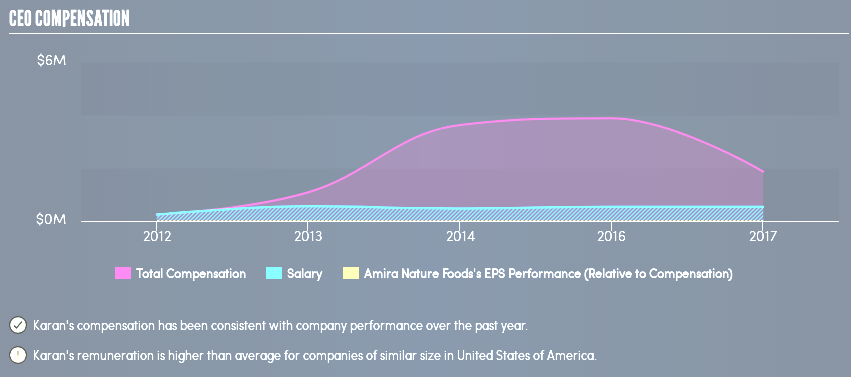

At the time of writing our data says that Amira Nature Foods Ltd has a market cap of US$29m, and is paying total annual CEO compensation of US$2m. That’s below the compensation, last year. We examined a group of similar sized companies, with market capitalizations of below US$200m. The median CEO compensation in that group is US$297k.

It would therefore appear that Amira Nature Foods Ltd pays Karan Chanana more than the median CEO remuneration at companies of a similar size, in the same market. However, this fact alone doesn’t mean the remuneration is too high. We can get a better idea of how generous the pay is by looking at the performance of the underlying business.

The graphic below shows how CEO compensation at Amira Nature Foods has changed from year to year.

Is Amira Nature Foods Ltd Growing?

Amira Nature Foods Ltd has reduced its earnings per share by an average of 54% a year, over the last three years. It saw its revenue drop -24% over the last year.

Unfortunately, earnings per share have trended lower over the last three years. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO.

With a three year total loss of 87%, Amira Nature Foods Ltd would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

Summary:

We examined the amount Amira Nature Foods Ltd pays its CEO, and compared it to the amount paid by similar sized companies. As discussed above, we discovered that the company pays more than the median of that group.

Earnings per share have not grown in three years, and the revenue growth fails to impress us.

Over the same period, investors would have come away with nothing in the way of share price gains. This analysis suggests to us that the CEO is paid too generously!